Borrowing Periods

*Estimated Weekly Repayment:

Apply Now

A weekend loan is essentially another name for a cash loan. The name comes from its purpose; you may need a weekend loan to go on a weekend getaway or spend your weekend doing some retail therapy.

Many lenders are not available during the weekends, but emergencies don’t limit themselves to certain days of the week, unfortunately. Thankfully, My Cash Online is here for you.

Apply Now

A short-term loan is a small loan designed to be repaid within a short period. These loans are under $2,000, with terms from 16 days up to 6 months. They usually feature quick applications and fast turnaround times.

It allows you to borrow a smaller amount of money and spread the cost over several months, giving you time to make the repayments.

Apply Now

A long-term loan is a form of loan that is paid off over an extended period of time greater than 3 years. This time period can be anywhere between 5-7 years.

With a long-term loan, you can borrow a larger amount of money and pay it back over a longer repayment period which makes your repayments more manageable.

This allows you to spread out your loan payments, reducing your monthly repayments. However because the loan is stretched out over a longer period of time, you’ll be making interest payments the entire term, driving up the total cost of the loan.

Apply Now

A same-day loan is any loan that’s disbursed the same day you’re approved for it.

If a surprise bill comes up because your car breaks down or you face another financial emergency, you may need extra cash quickly to make ends meet. A same day loan helps and can get you cash right away.

Apply Now

A quick loan is designed to help you out when you most need it and are therefore typically assessed, approved, and disbursed on the same day as they are applied for.

A sudden financial crisis is unavoidable for anyone. If your car engine’s playing up or your boiler’s broken down, you need a solution fast. Our quick loans can provide you with that.

Apply Now

A payday loan is a quick form of finance that is repaid in one payment, usually on your next payday. Its principal is typically a portion of your next paycheck.

Once you’re approved for a payday loan, you may receive cash or a check, or have the money deposited into your bank account. You’ll then need to pay back the loan in full plus the finance charge by its due date, which is typically within 14 days or by your next paycheck.

Apply Now

In its broadest sense, an online loan is any kind of loan that’s not directly from a traditional bank. Online loans let you complete the entire borrowing process, from prequalification to loan funding, without ever setting foot inside a bank branch.

They can be a convenient way to borrow money, and online-only lenders could offer lower rates or have less stringent requirements than you can find with traditional lenders.

MyCashOnline is a 100% online lender which is a straightforward way to borrow. Apply online using our simple application form and get a quick initial decision.

Apply Now

Fast cash loans are salary loans and personal loans that can be approved in as fast as 10 minutes to just a few days. This particular type of loan is offered by a variety of lenders, ranging from local cooperatives to large consumer banks.

Because this type of loan is granted fast, you can have immediate access to funds exactly when you want or need it. This makes it the ideal financial support for your emergencies.

Sometimes, life throws unexpected costs our way. If an appliance breaks down; a bill needs paying; payday comes a little late; or financial emergencies... Apply Now

An emergency loan is a form of short-term that covers your expenses in case of an emergency. They are most used to help borrowers pay for unexpected expenses such as paying for car repairs or to get that broken boiler fixed during the depths of winter.

Unlike other forms of borrowing such as payday loans, this form of credit is designed to help pay for immediate, one-off spends which just can’t wait. Emergency loans almost always come with very short terms (usually weeks or months).

Apply Now

Applying for multiple loans can also affect your credit score negatively, with no indication of whether or not you’ll be accepted beforehand this can be frustrating.

An easy loan is usually referred to as quick short-term loans that are easy to apply for and enable you to get an instant decision on whether or not you qualify.

Apply Now

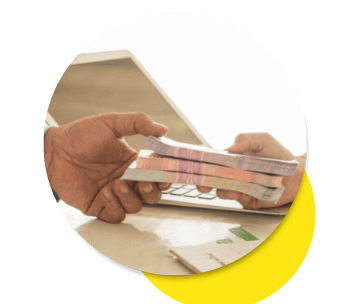

A cash loan is a form of short-term financing solutions for consumers, usually for a loan term no longer than 2 years.

It is a small amount loan that is approved and cleared into your account quickly, which is ideal if you need money for an unexpected cost.

Apply Now

A Cash Advance loan is a quick, small loan that is repaid on your payday or over multiple paydays on a repayment schedule. 、

It also features fast approval and quick funding.

Apply Now

A bad credit loan is an amount of money lent to someone with a poor credit rating. This allows people to borrow funds without the automatic judgment and denial that often comes from many financial institutes.

A poor credit rating isn’t always the full story. With a bad credit loan, My Cash Online will consider a range of factors before making a decision on your application.

Apply Now

In today’s fast-paced world, access to flexible financial solutions is crucial. Whether you’re planning to start a business, make a significant purchase, or tackle unexpected expenses, having the right financial tools at your disposal can make a world of difference. One such tool that offers financial freedom and stability is a security loan. In this comprehensive guide, we’ll delve into the world of security loans, exploring what they are, how they work, and why they might be the right choice for your financial needs.

What Are Security Loans?

Security loans, also known as collateral loans, are a type of secured... Apply Now

What is a Collateral Loan?

A collateral loan, also known as a secured loan, is a type of loan where the borrower pledges an asset as collateral to secure the loan. This collateral acts as a guarantee that the lender can seize and sell if the borrower fails to repay the loan as agreed. Common types of assets used as collateral for loans include real estate, vehicles, jewelry, and even investment portfolios.

Benefits of Collateral Loans

Bridging finance with transparent and fair costs and no hidden fees

Unlike most lenders, we stay committed to our customers throughout the life of the cash direct loans.

Everybody who apply for instant approval loans need cash today. They want to know about the results of their fast payday loans application instantly. So, we work our best and aim to deliver results of their quick payday loans within 60 minutes as soon as we receive your paydayloans application so that you can get your cashtoday.

Pre-qualification Certificate helps you understand how much you can afford before you start shopping. Apply for your cash loans today!

We ensure complete transparency about anything and everything. You don’t worry about a thing. There are no hidden charges. All the costs are explained beforehand. So, you can ease off and apply for your cashies loan today!

We start processing the application immediately. Next step is to sign the contract online or electronically after approval and money is transferred to your bank account in few hours.

We value our customer’s information. We place security and safety first. So, everything that is provided to the company is 100% secure.